There is now updated information and guidance on the VAT reverse charge.

Members can log in here

There is now updated information and guidance on the VAT reverse charge.

Members can log in here

From 6 April, changes to the IR35 rules will mean that medium and large organisations employing workers through an intermediary will have responsibility for determining a worker’s employment status. Build UK has published a practical guide and a checklist to help members prepare for the new rules.

Business travel and mutual recognition of qualifications are both topics explained in the UK Government's new on demand videos which focus on priority topics for businesses.

You can also download a step-by-step guide on how to navigate the new rules on business travel to the EU.

You can also use the Brexit Checker tool on gov.uk/transition, which will provide you with a personalised list of the most up to date actions that your business needs to take.

Moving goods to Ireland

Irish Customs have introduced some additional functionality for those using the Pre-Boarding Notifications service - providing text and email updates for channel routings for loads. For more information, click here.

List of customs agents and fast parcel operators

The list of agents and operators who can help submit customs declarations, has been updated. For more information, click here.

A new summary of actions SMEs may need to take to trade with the EU is now available.

The document provides an overview of actions to take, outlines support, helplines and resources that may be useful for SMEs, and signposts more detailed guidance on Government websites.

To view the toolkit, click here

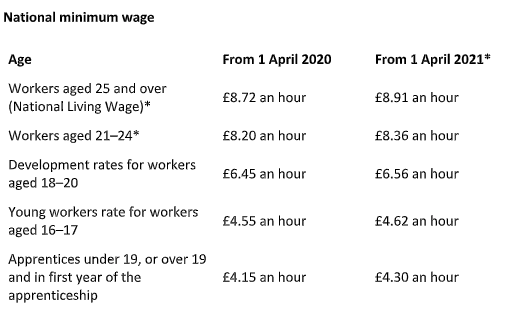

The National Living Wage will increase by 2.2% from £8.72 to £8.91, and will be extended to 23 and 24 year olds for the first time. For workers aged under 23, Commissioners recommended smaller increases in recognition of the risks to youth employment which the current economic situation poses.

The Coronavirus Job Retention Scheme (CJRS) has been extended until the end of September 2021.

The UK Government will continue to pay 80% of employees’ usual wages for the hours not worked, up to a cap of £2,500 per month, up to the end of June 2021.

For periods in July, CJRS grants will cover 70% of employees’ usual wages for the hours not worked, up to a cap of £2,187.50. In August and September, this will then reduce to 60% of employees’ usual wages up to a cap of £1,875.

You will need to continue to pay your furloughed employees at least 80% of their usual wages for the hours they do not work during this time, up to a cap of £2,500 per month. This means, for periods between July and September, you will need to fund the difference between this and the CJRS grants yourself. You can also top up wages above the 80% if you wish, but you are not required to do so.

You must continue to pay the associated Employer National Insurance contributions and pension contributions on subsidised furlough pay from your own funds.

The Prime Minister has confirmed the Government’s fourâ€step plan for a ‘cautious’ route out of lockdown in England. The current restrictions will be gradually relaxed, beginning with schools and colleges reopening from 8 March, and four specific tests will need to be met at each stage before further restrictions are lifted. The comprehensive roadmap confirms that individuals should continue to work from home where they can until at least 21 June, which is the fourth step and when social distancing measures will be reviewed.

The Scottish Government is expected to set out its plans for easing restrictions this week, with the Welsh Government due to review its current measures on 12 March and the Government of Northern Ireland on 18 March.

You can now submit your claims for periods in February. These must be made by Monday 15 March.

You can claim before, during or after you process your payroll. If you can, it’s best to make a claim once you’re sure of the exact number of hours your employees will work so you don’t have to amend your claim later.

Check if you and your employees are eligible and work out how much you can claim using the HMRC CJRS calculator and examples, on GOV.UK.

What you need to do now

If you deferred paying VAT due in the period from 20 March to 30 June 2020, you should pay it by 31 March 2021 if you can.

If you can’t afford to pay by 31 March 2021, you can join the VAT deferral new payment scheme and pay your deferred VAT over a longer period.

The online service will open on 23 February 2021 and close on 21 June 2021. You can make up to 11 monthly instalments, interest-free. The earlier you join, the more months you can spread your payments across.

You can join the scheme online without the need to call – go to GOV.UK for more information or to join quickly and simply when the scheme opens.

If you need more time, please contact HMRC – go to GOV.UK.